When it comes to the global economy, the discussion has narrowed in recent months to the near term. Will we see another global financial crisis? Will the price of a barrel of oil over $150 for the first time in over 15 years? If former President Trump gets reelected, will his tariffs trigger another trade war?

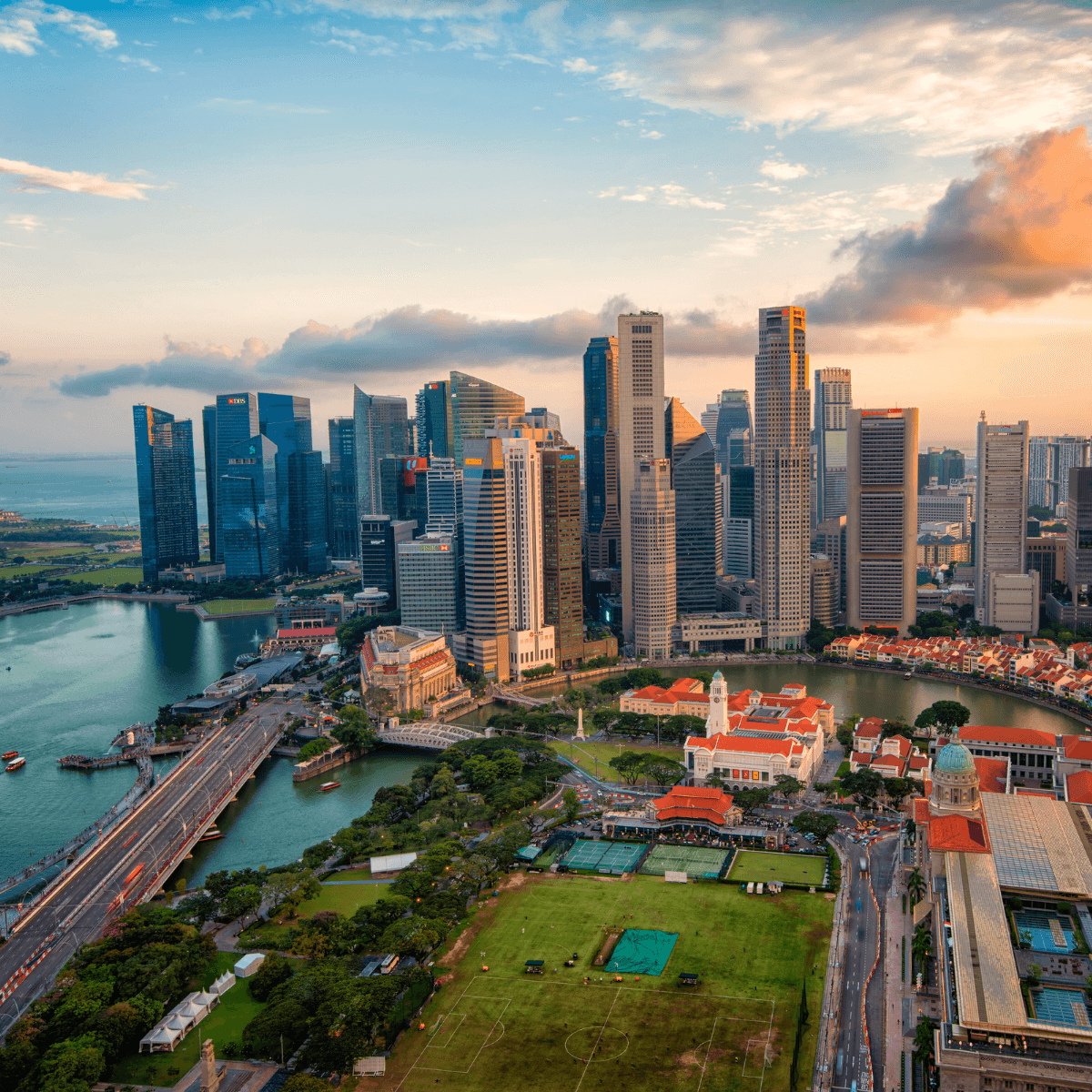

While these eventualities, if they come to pass, would have far-ranging consequences whose implications may be measured in years and possibly decades, there is a megatrend that may dwarf these mega events: the continued shift in wealth from the West to the East. The global economy used to be the effective dominion of the West—particularly the Group of Seven (G7)—but in the future, the global economy will be more evenly balanced.

The G7 consists of the world’s biggest economies in the West, including the United States, the UK, Canada and the big European markets—France, Germany and Italy—and also includes Japan. Out of nearly 200 countries in the world, these seven countries make up nearly 60% of global wealth and nearly half of the global GDP. The world has got used to the G7 calling the shots, just as it has got used to the dollar as the world reserve currency—the backstop that makes the global economy tick.

An aging but prescient PwC report shows that while the west will keep growing, another group of countries is set to grow faster. By 2050 the Emerging Seven (E7)—the economies of China, India, Brazil, Mexico, Russia, Indonesia and Turkey—will be 50% larger than the G7. E7 economies will grow at an average growth rate of 3.5% over the next 34 years, compared to 1.6% for the G7. China is going through growing pains, but it is still on course for 5% annual growth this year, and should be the world’s biggest economy by 2050, with India in second place. And while the average incomes in the G7 should continue to be above the E7 by 2050, it’s the global growth engines of Asia that will give the world a new army of middle-class consumers.

The E7, and a wide supporting cast of countries who can see this direction of travel are preparing for this and managing their economies, alliances and strategic partnerships to be more to their own advantage. As they do so, they must face their own challenges across their institutions and infrastructure, and chart their own journeys through disruption. As a consequence, many of the projections for Asian economies years and decades into the future are naturally speculative.

But it is clear that if the centre of economic gravity is shifting, then the E7 will also reshape global power structures, both by stress-testing the Bretton Woods multi-laterals, and by asserting their own worldviews and desire to do things differently through new groups such as BRICS (Brazil, Russia, India, China, South Africa, Iran, Egypt, Ethiopia and the United Arab Emirates). Of course, this is already happening, but the bigger picture, the inexorable migration of economic power, is perhaps underplayed.

The shift in wealth from G7 to E7 economies is one of the biggest realignments in the global economic order ever seen. It is an opportunity for the East, but it is also an opportunity for the West. The West and the East need to find ways to accommodate each other amid recast economic power dynamics, but this should be seen as an opportunity to modernise the global economy from all sides, and for nations in both hemispheres to show a long-term mindset that transcends short term political thinking. Are groups of nation states collectively capable of that? We will have to see, but consideration of this reminds us that important, strategic questions are as vital as urgent, immediate problems.