Corporate leaders and dealmakers increasingly see acquisitions as a way to accelerate sustainability strategies, creating new challenges for communicators.

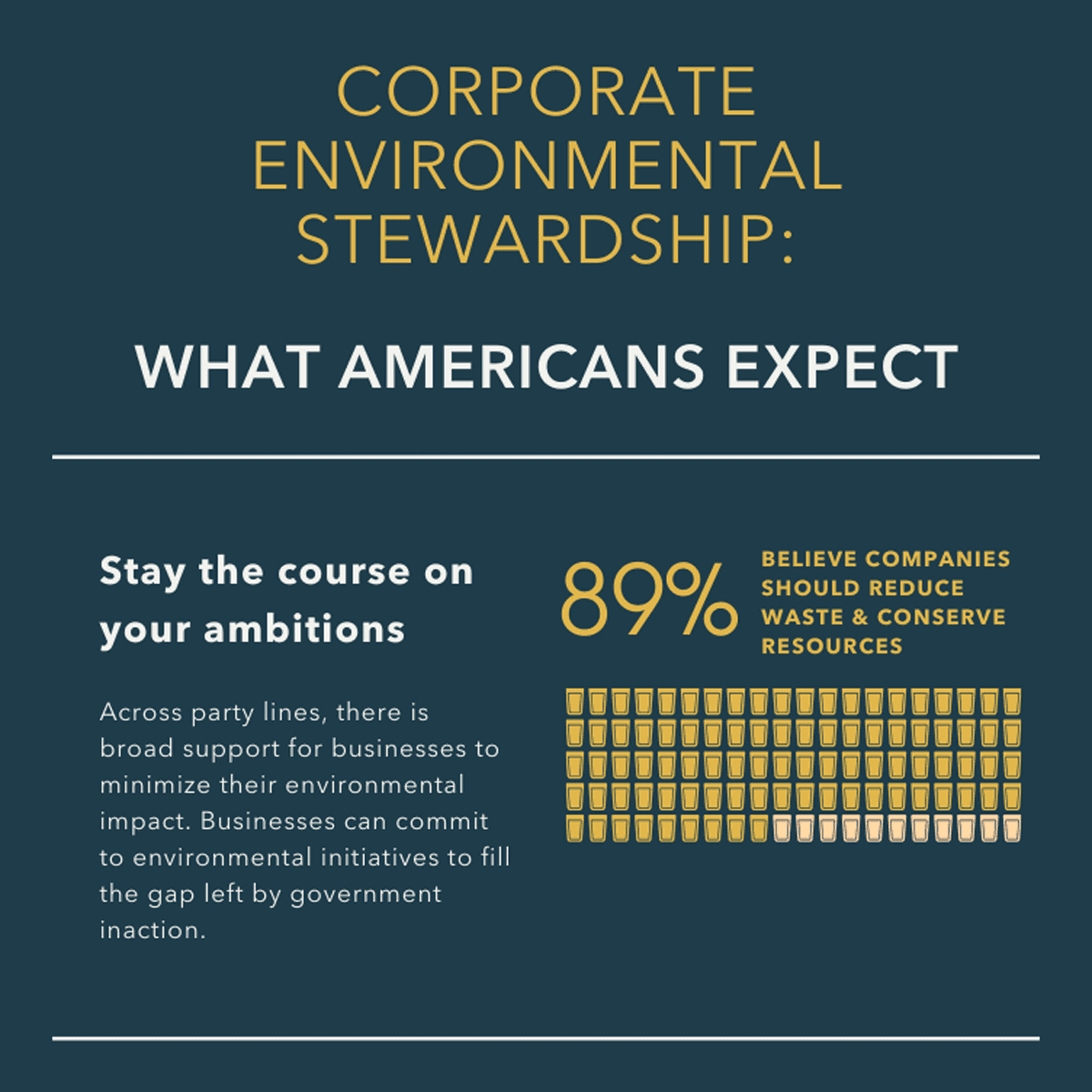

- Greening the business can be essential for maintaining a competitive edge and meeting customer expectations—but watch out for greenwashing and purpose washing.

- Shareholders are asking boards of directors how business strategy and portfolio decisions are consistent with a net zero carbon economy—and want to see a credible roadmap.

- Workforce, supply chain and community issues take on heightened importance in M&A when they test corporate commitments to social impact and stakeholder capitalism.

- The regulatory direction of travel increases ESG-focused deal flow, complicates divestments of assets with a large environmental footprint, and makes public affairs due diligence essential.

ESG M&A trends are not just a blip on the horizon. In 2021, nearly 800 M&A deals were considered “sustainable” according to Refinitiv, up 44% year on year. EY’s 2022 CEO survey finds that six out of 10 CEOs expect their companies to pursue acquisitions this year with 20% saying their primary planned M&A activity will be to “strengthen ESG ranking/performance/sustainable footprint.” Private equity firms raised another $700 billion in ESG-focused funds last year to keep on the hunt for acquisitions and meet demand of pension funds and other institutional investors for ESG investments.

In a 2021 survey of corporate communications professionals conducted with the Arthur Page Society, APCO Worldwide found 74% believe the leaders of tomorrow will be defined by ESG actions, not just commitments, and a majority cite the need to embed ESG in financial decisions and incentives. Social good was a key theme when we surveyed investors about M&A deals a few years ago, with two-thirds saying it’s important for companies to demonstrate broader economic and social benefits.

Any way you look at it, due diligence on environmental risks and costs of an acquisition target’s footprint should be part of the management decision-making and deal communications toolkit. This is necessary to calculate scope 1, 2 and 3 emissions, the impact of negative externalities and future liabilities—which carry financial risks and potential for shareholder, political and media backlash.

An ESG lens can identify opportunities for environmental performance improvements or new strategies to reduce carbon and waste intensity. Oil & gas giants are under pressure from activist shareholders to step up actions on climate risk and energy transition strategies. Sustainability goals are fueling a surge in green investments and M&A deals in other sectors. HP recently acquired Choose Packaging, inventor of the only commercially available zero-plastic paper bottle in the world, in a move to build on its 3D printing solutions to disrupt the $10 billion fiber-based sustainable packaging market. Global retailer IKEA’s parent company has invested billions in wind turbines and solar parks and even forests to meet its sustainability targets and support a broader societal transition.

Social factors have always had a role in transactions (often in terms of impacts on jobs and local communities) but corporate commitments to ESG and stakeholder capitalism bring new issues to the fore. For example, when Intel announced its $20 billion investment in Ohio to make it one of the largest semiconductor manufacturing sites in the world, it went to great lengths to communicate benefits for the U.S. economy, supply chain resilience, local communities and businesses, including tens of thousands of tech jobs. And recognizing the need to develop a robust local pipeline of skilled talent in the region, the company also committed to invest $100 million in partnership with Ohio universities and community colleges.

DEI can present new challenges for M&A. Progress on diversity, equity and inclusion is hard enough for companies to achieve on their own, but how should they approach DEI as part of M&A and post-merger integration? Management consulting firm Deloitte developed a DEI M&A framework “to set the foundation for an inclusive, equitable culture and actively manage bias even before the deal is announced.” It encompasses talent, brand, customer, community, infrastructure, data analytics and leadership factors for establishing a combined culture of diversity and inclusivity.

That brings us to Governance issues. Bad governance can sink a company or put it at risk of a takeover, with the #MeToo misconduct scandal at Activision being a prominent example. Similarly, poor post-merger integration can fail to remedy unethical or fraudulent practices or a toxic workplace culture.

Good governance includes guarding against geopolitical and legal risks such as doing business with Russia as it wages war on Ukraine and complying with laws requiring companies to prove their supply chains do not use forced labor. Deal preparations require a regulatory and public affairs strategy that anticipates global antitrust and competition trends. Businesses should also prepare for climate risk and ESG regulatory disclosures under proposed rules in the United States, EU and other jurisdictions.

Finally, a merger creates opportunities to advance corporate governance by establishing a new board of directors that meets or exceeds new rules and expectations for board diversity, and linking executive compensation to ESG metrics for KPIs the board wants to incentivize. The merging companies need to establish a strong ESG governance structure for the combined business and integrate policies and commitments into strategy, operations and targets. They can articulate a renewed purpose that motivates employees, inspires consumers and delivers long-term value for their stakeholders.

Related Articles

Going Grassroots: 5 Key Learnings from Community Grants

April 16, 2025