This week, APCO convened an expert panel discussion, “Trump’s Trip to Asia: What Happened, What Did We Learn & What’s Coming Next?” as part of its Agenda 360 series. This timely briefing explored the evolving dynamics of the Trump administration’s trade and national security policy following President Trump’s trip through Asia. In light of the deals and frameworks recently agreed to, panel members analyzed global trends to anticipate future developments and provided suggestions for businesses.

Moderated by Rosalind Reischer, senior associate director based in Washington, D.C., the event featured expert insights from Jon Lang, senior director for Economic Security and former director for International Economic Affairs in the White House National Economic Council and National Security Council; James McGregor, chairman, Greater China; and Jane Zhuang, associate director based in Shanghai.

Here are some highlights from the conversation:

- Both sides were looking to de-escalate.The United States and China have reached a much-needed truce following a flare up in trade tensions in October over export controls and tariffs. The ultimate outcome of the deal is not a full-fledged agreement, but more so an understanding to deescalate tensions and avoid mutually harmful brinkmanship.

- The U.S.-China détente is tenuous. Despite multiple touchpoints built into the one-year truce timeline, the persistence of fundamental disagreements on issues such as overcapacity, a range of non-tariff barriers and the possibility of unilateral actions make periodic escalations likely and the deal tenuous.

- Export controls are deal-able while U.S. investments are not. Export controls are no longer distinct from other areas of economic policy, including trade and market access considerations. Both the United States and China agreed to delays in this space as part of a larger deal, but U.S. interest in inbound investment was not extended to China, something unlikely to change in the near term.

- Leverage, leverage, leverage. The second Trump administration is not only focused on reducing bilateral trade deficits, but a broader range of goals including revenue generation and manufacturing incubation. Tariffs are also now the primary pressure mechanism to extract concessions and enforce policy alignment on both trade and non-trade issues.

- Welcome to the G2. Trump administration officials have shifted tone on China, with Ambassador Perdue referring to the current moment as the “new 1979.” Secretary of War Pete Hegseth even referred to the post-truce relationship as the new “G2,” a sentiment that previous administrations sought to avoid so that traditional Western allies would not be sidelined.

- Buying time and defining next steps. The agreement gives both sides extra time to pursue aspirations of technological and market self-sufficiency, while also outlining a path toward détente over the next year. For China, this newfound breathing room allows Beijing to continue strengthening trade ties with regional partners and develop home-grown technologies that rival U.S. components. Similarly, the United States will use this truce to advance trade negotiations elsewhere, implement domestic policies that drive industrial development and continue to diversify supply chains away from China, particularly in critical minerals and rare earth elements.

Business Suggestions

- Monitor the tariff differential. Tariff rate adjustments may incentivize investment and provide countries with competitive advantages over regional and sectoral competitors. However, companies will need to account for potential fluidity in China’s overall tariff rate and outstanding details of the ASEAN (Association of Southeast Asian Nations) deals, such as transshipment and content requirements.

- Supply chain transparency is still critical. There are many moving parts to this truce which, despite the current détente, will continue to pose risk. Knowing your product supply chains — and the value chains of critical component inputs — is essential to identifying risk, seizing opportunity and strategizing during this period of relative stability.

- Stay up to date. The Supreme Court’s upcoming decision on President Trump’s use of the International Emergency Economic Powers Act (IEEPA) may affect the administration’s tariff policy levers, concluded deals and ability for companies to claim tariff refunds. More broadly, deal execution and implementation of future Section 232 tariffs serve as additional bellwethers for the administration’s policy roadmap.

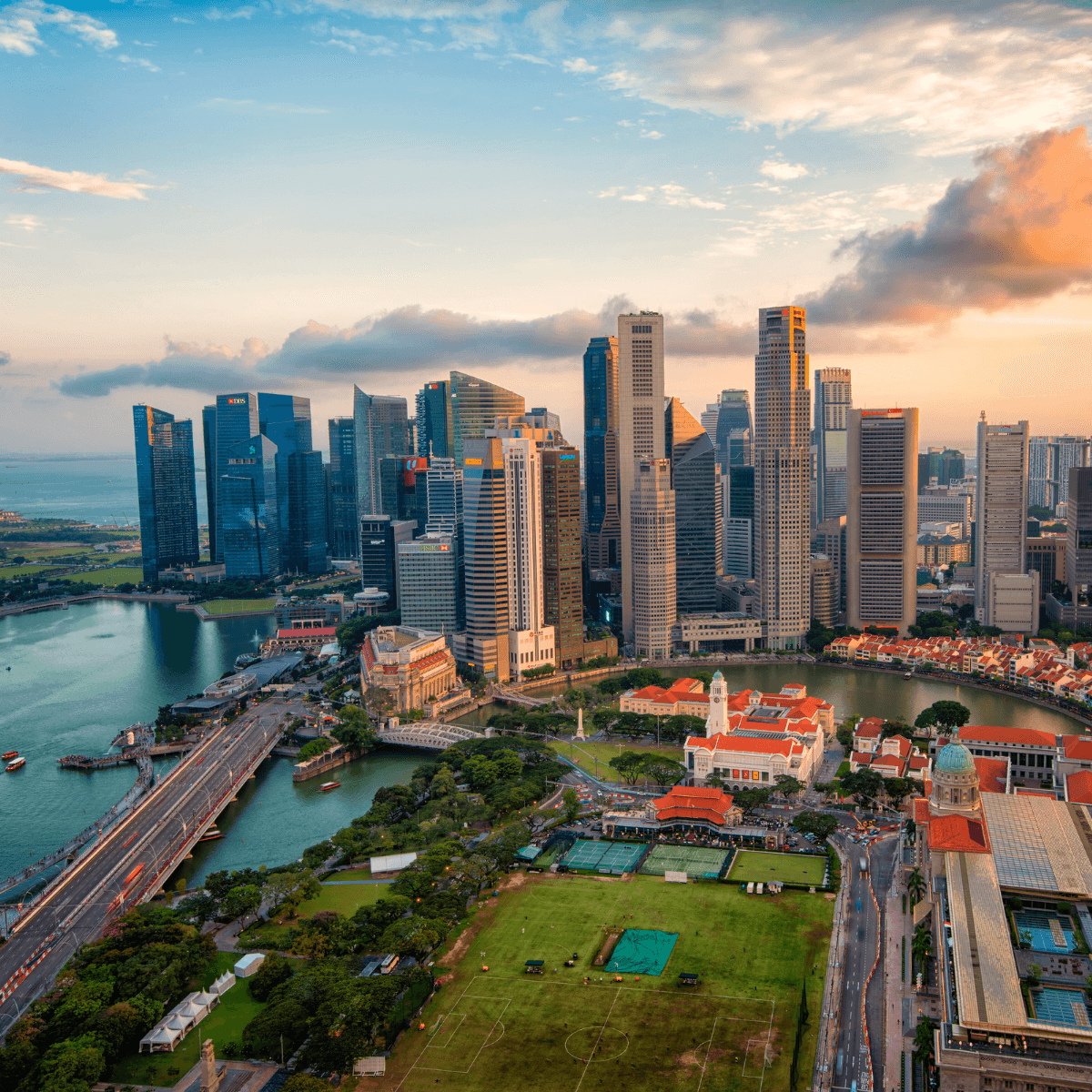

Photo: The White House