APCO’s Top 6 Takeaways From the World Bank and IMF 2024 Annual Meetings

October 31, 2024

APCO alumnus Annaleigh Mills co-authored this piece.

With the Fall 2024 Annual Meetings of the World Bank Group and the International Monetary Fund (IMF) wrapped up, the APCO team is once again putting a data-centric lens to the week’s conversations and outcomes to highlight trending topics, influential voices and major takeaways that will continue to influence the global agenda through 2024 and beyond.

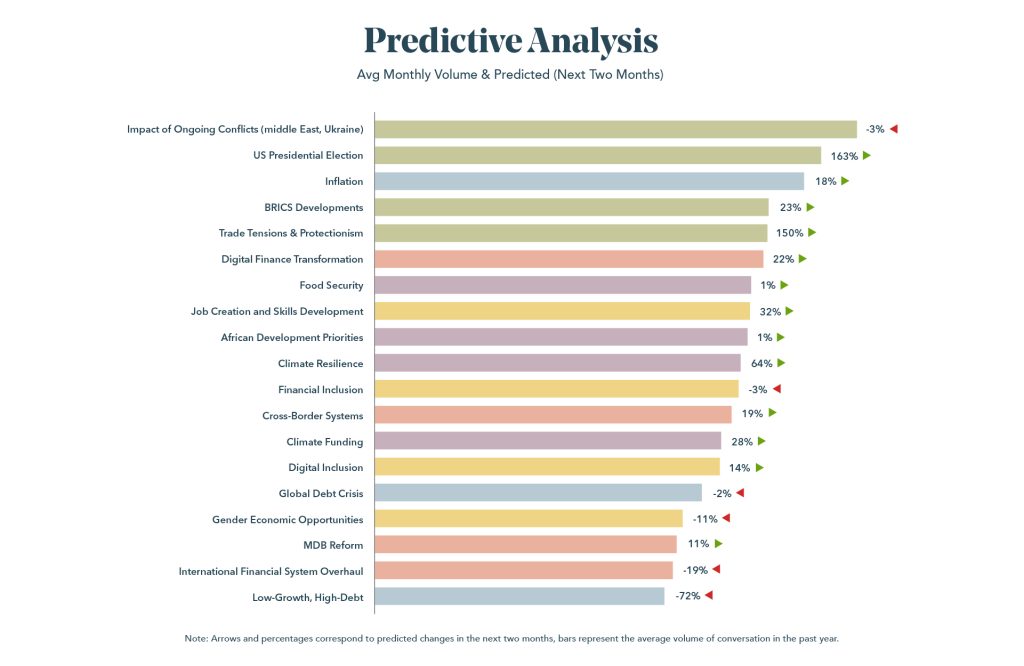

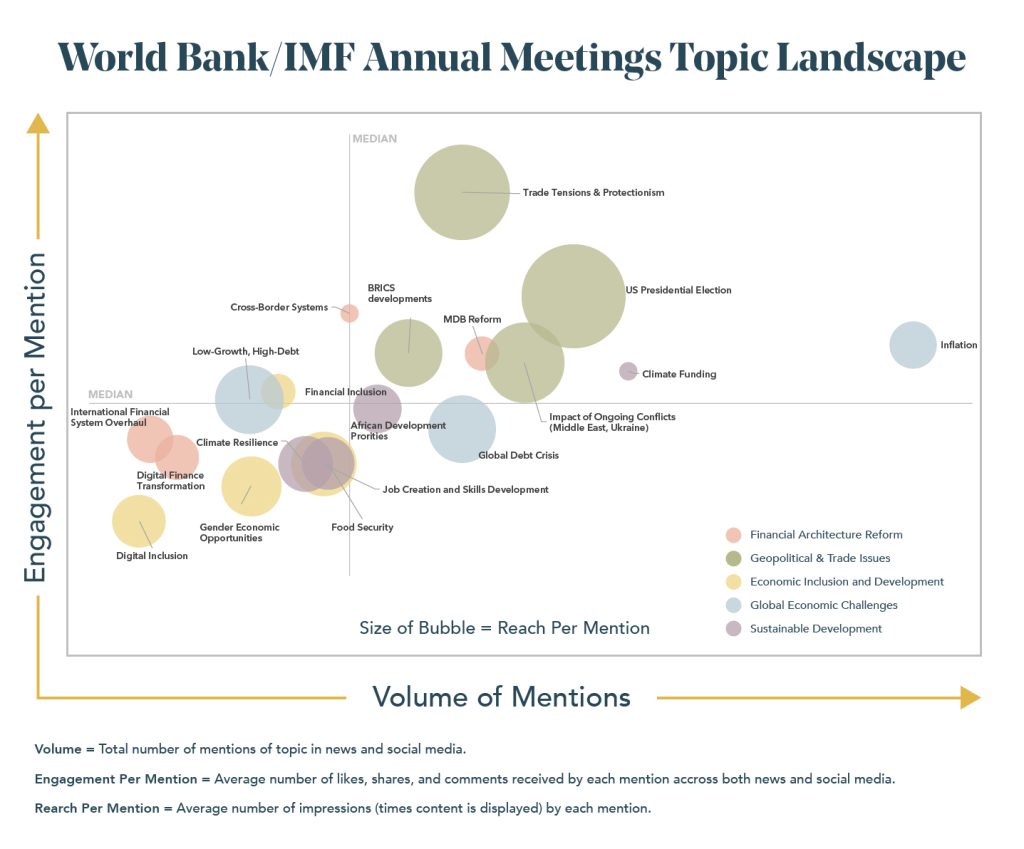

1. The topic of global debt crisis captured major concerns about the trajectory of the global economy, including continued inflation (the top trending topic with the most mentions across traditional and social media channels, 5.3k compared to 800 average), low growth forecasts in China and across the Eurozone and the challenge of creating economic stability while managing the global public debt levels approaching $100 trillion. The meetings were also notably light on multilateral development bank reform (sixth highest trending topic with 2.9k engagements), with the IMF only loosely committing to considering changes to the Fund’s governance reform in 2025, and the World Bank seemingly more focused on the replenishment round of its International Development Association fund for lowest-income countries. The IMF did approve reforms to its borrowing surcharge policy, a potential annual savings of $1.2 billion, which has been historically criticized for penalizing member economies already in distress.

2. While not on the Meetings’ official agenda, the upcoming U.S. Presidential election was the second highest trending topic and garnered the most impressions (8.1 billion impressions compared to 1.5 billion average) and an unspoken undercurrent of conversations throughout the week. Participants focused on how potential political changes might affect everything from trade policy and tariffs to the U.S. development aid budget, as well as leadership’s broader commitment to the Bretton Woods Institutions and the outlooks for future international economic cooperation. Influential voices, including European Central Bank President Christine Lagarde and German Finance Minister Christian Linder, warned of economic uncertainty that could result from increased trade tensions and protectionism (third highest and most engaging trending topic), emphasizing the impact that the U.S. election results could have on the global economic landscape.

3. Similar to UNGA Week in September, climate resilience continued to be a core theme of last week’s meetings, with calls to mobilize analytical, technical and financial resources to boost mitigation, adaptation and resilience measures, especially in most vulnerable regions. IMF Managing Director Kristalina Georgieva urged member countries to eliminate fossil fuel subsidies to free up climate funding (fourth highest trending topic with 1.8k mentions, 5.2k engagements, 314m impressions) for the green energy transition, while the European Investment Bank and the Caribbean Development Bank announced $100 million partnership to support clean water and flood prevention projects across 14 Caribbean countries.

4. Food security was also a prominent topic of the week, cutting across conversations around climate, the energy transition, job creation and the broader global development agenda. The World Bank announced a major commitment to double its agribusiness funding to $9 billion annually by 2030, indicating growing concerns around the sector’s growing vulnerability to climate risks, as well as the need for more global financing to advance smart agriculture through effective public policy, digital tools and other support mechanisms for small farmers and producer organizations. Food security is a conversation especially relevant to African development priorities (a top 10 trending topic), where agricultural small and medium-sized enterprises face a $100 billion gap in unmet financing needs, despite serving as a key source of employment and economic growth for the region.

5. Job creation and skills development was a trending topic of the week, reflecting the cross-cutting nature of conversations around aligning policy priorities with broader climate, energy transition, food security and gender targets vis-à-vis job creation and finance mobilization. According to World Bank President Ajay Banga, whose institutional reform efforts were praised by U.S. Treasury Secretary Janet Yellen, only 420 million jobs will be available for next decade’s 1.2 billion young job seekers in low- and middle-income countries. There is an opportunity to create policy mechanisms that serve as preventative measures and enable skill mobility reflective of today’s transformative digital innovation.

6. Looking ahead to 2024’s major convenings like COP 29 and the G20 Summit, as well as to 2025’s key global moments like the World Bank/IMF Spring Meetings and the International Conference on Financing for Development, we can expect to see climate resilience, trade tensions and protectionism and multilateral bank reform to continue as the top conversation drivers. The U.S. presidential election will dominate conversations for months to come, while job creation and skills development will remain a trending theme, especially as conversations around AI regulation, digital inclusion and digital finance transformation’s impact on economic growth and the jobs landscape progress. Undoubtedly, this dialogue will continue to evolve and reflect the dynamic nature of today’s major challenges—and we will be here to monitor the conversations and influential voices to keep you informed of what’s trending on the global agenda.

These takeaways were derived from English-language traditional and social media data gathered October 21-27 using APCO Insight’s digital and social listening proprietary tools that help clients understand their operating environments through digital analytics. APCO also supports our clients at major global convenings; you can learn more about APCO’s global engagement work here.

Photo: IMF