Today, a company’s performance on ESG is an important signal of value to the marketplace. According to the CFA Institute, 73 percent of investment professionals say ESG ratings will have a greater impact on cost of capital in the next five years. And while there are efforts to align on the most material aspects of ESG, particularly among raters and standards groups, there is no one formula for measuring performance and demonstrating value. This lack of definition can be a source of frustration, particularly for companies that have developed best-in-class programs and been quick to report and disclose progress. The question of “why aren’t we getting credit?” is a common one. The answer is complex, but the following insights yield some answers and a possible prescription:

- Disclosure doesn’t equal Performance. The Conference Board released a new report, “International Evidence on the Mismatch Between Firms’ ESG Disclosure and ESG Performance,” that measures the disclosure-performance gap by country and industry. One of the interesting findings was that internal governance factors played a significant role in decreasing that gap. Among the key governance issues are board diversity, director independence and presence of outside investors. The “G” continues to be a critical value driver, although the “E” and “S” drive most of the conversation.

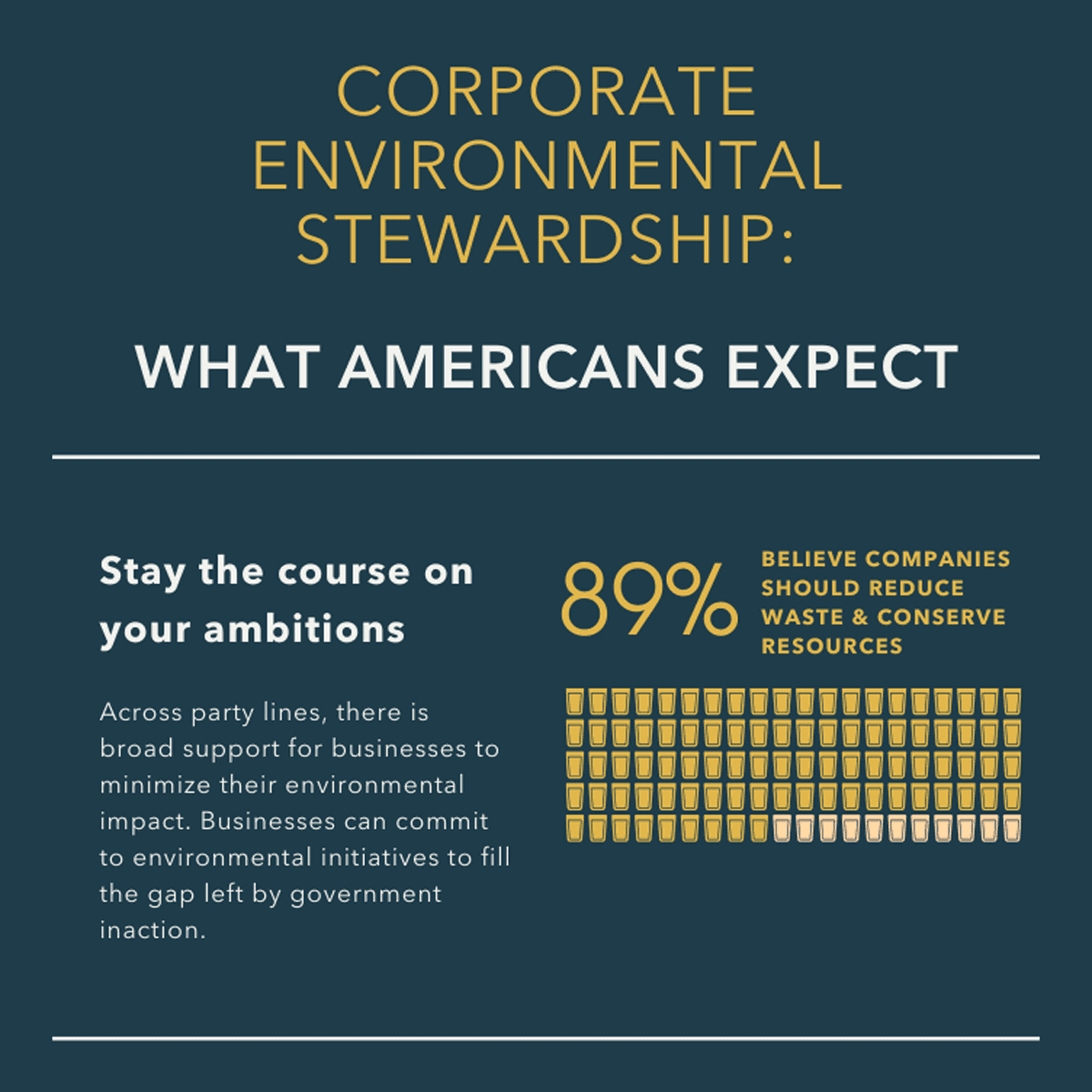

- Despite increasing disclosure of more hard data, “perception” is a softer measure that still drives performance and value. According to a by George Serafeim at Harvard Business School, corporate ESG performance has two to three times the effect on market valuation for a company with positive public sentiment momentum. Even for rating agencies like MSCI, around 50 percent of ESG rating depends on sources of sustainability information outside of company reporting

- Finally, it’s what covered outside the walls of the company, not just what the company discloses, that will matter more as analysts leverage artificial intelligence. One example is Refinitiv MarketPsych ESG Analytics, which leverages AI-based technology to offer an “outside-in” perspective of sustainability performance and minimize corporate “greenwashing.” According to a recent press release, the company “processes millions of global articles and social media posts in near real-time.” And while their feed works in real time, the data history extends back to 1998, providing a perspective of how media perceptions relate to business performance over time.

So, what are the implications for companies that are building ESG infrastructure, programs and engagement strategies? And how can companies better ensure that the efforts they make to build toward more inclusive capitalism are reflected in their ESG performance scores? Here are five starter thoughts:

- Keep up the conversation. Recognize that one-and-done announcements, even on topical issues like net-zero, will not move the needle in meaningful ways.

- Remember the “G.” The less discussed cousin to the “E” and “S” is the engine that will drive performance and continuous improvement and help avoid the gap in disclosure and performance.

- Integration is Key. Too often the commitment and narrative surrounding ESG are siloed. Companies that integrate the narrative behind their ESG approach across channels are more likely to see that same message reflected in public discourse.

- Stand for something(s) or somebody(ies). Advocacy is still a powerful way to drive change and help build perception value, especially if done in partnership.

- Double-down on good issues and crisis management. Anticipating and managing risk and identifying opportunities is the first step in shaping positive sentiment.

Related Articles

Going Grassroots: 5 Key Learnings from Community Grants

April 16, 2025