The Business Roundtable has veered away from its long-held philosophy of shareholder primacy: that corporations exist to maximize shareholder value. Its revised Statement of the Purpose of a Corporation, signed by nearly 200 CEOs of the largest companies in the United States, signals a commitment to all stakeholders—customers, employees, communities, suppliers and shareholders—to create long-term value and “economic opportunity for all.”

This is new. As Fortune’s Alan Murray commented, “In the past few years, it has become clear to me that something fundamental and profound has changed in the way [CEOs] approach their jobs.” Two questions arise in reaction to this statement of corporate purpose and its endorsement by America’s business leaders. Why did they do it – and what comes next?

Why: Next-generation talent and consumers, license to operate and financial performance

It seems logical that doing better by your stakeholders contributes to greater shareholder value. In practice, the trade-offs are challenging to negotiate and the idea has been slow to take hold.

What’s new is a fundamental shift in social and governmental activism coupled with technological and generational change. This combination of factors has raised the stakes for business leaders who misread the operating landscape and fail to take action in reinventing their organizations and embracing a stakeholder-oriented world view.

Millennial (and now Gen Z) workers, who already account for the majority of the American labor force, want workplaces with social purpose. They expect employers to demonstrate a strong sense of corporate social responsibility. Businesses are increasingly hearing from employees themselves, directly and via social media activism.

With the stock market near record highs and interest rates near historic lows, financial capital is widely and cheaply available to large companies. But human capital is scarce, and U.S. companies are fighting a war for the next generation of talent.

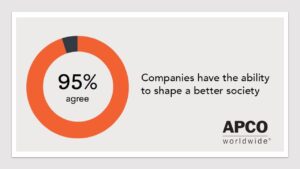

In some ways, winning this talent war is more important than winning market share. In other ways it amounts to the same thing, as today’s consumers are also more socially conscious in their perception of brands. APCO’s research found that nine out of 10 Americans expect companies to be involved in taking on society’s most pressing concerns.

Political capital is also scarce. Companies are increasingly finding their license to operate under attack in large ways and small. The ongoing presidential campaign offers daily reminders of the distrust in large corporations and highlights many voters’ skepticism towards the very essence of capitalism.

These facts are not lost on the CEOs or boards of directors looking more holistically at the stakeholder landscape. What is perhaps less obvious is that investors also value the whole picture.

Studies consistently find that improvements in governance and sustainability are associated with improved corporate performance over the medium and longer term. The latest, issued by Bank of America Merrill Lynch in September 2019, concludes that an investment strategy of buying companies that rank high on environmental, social and governance (ESG) metrics would have outpaced the broader market, while earnings for companies with poor ESG scores are significantly more volatile.

The cost-cutting CEO today is no longer as celebrated as the Wall Street hero of yesteryear. Investors understand that successful companies need to be able to drive innovation and deliver transformative solutions that benefit customers and society. They have been sensitized to the value at stake from failing to manage regulatory or social risks, and the need for good internal culture and talent management.

What’s Next: Either lead or fall behind in the new stakeholder landscape

Shared value is easy to say, but hard to do. This will be a journey for Corporate America.

By signing onto the Business Roundtable’s statement, CEOs have effectively held themselves, and their companies, to account if they talk the talk, but don’t walk the walk.

A statement is not action, notes APCO IAC Member Barie Carmichael. “Purpose washing” has become a thing. And the backlash of getting outed when actions do not meet high-minded purpose statements disrupts business and erodes value.”

Companies need to take an outside look at their blind spots. They can take bolder corporate stands but they need to be brutally honest with themselves about testing their stakeholder vulnerabilities and potential sources for backlash.

An in-depth APCO study of Fortune 1000 companies found that many executives are feeling less confident about handling the major challenges of today—recruiting and retaining the best talent, addressing increasing societal expectations, facing the challenge of new and unexpected competitors, and responding to geopolitical threats.

The research found that those with higher scores on a variety of corporate agility metrics were significantly more likely to report they had exceeded revenue expectations and increased their stock price compared to organizations with low agility scores.

CEOs need to lead their organizations in assessing corporate purpose, and the positive and negative alignments of business and stakeholder interests. And then they need to act.