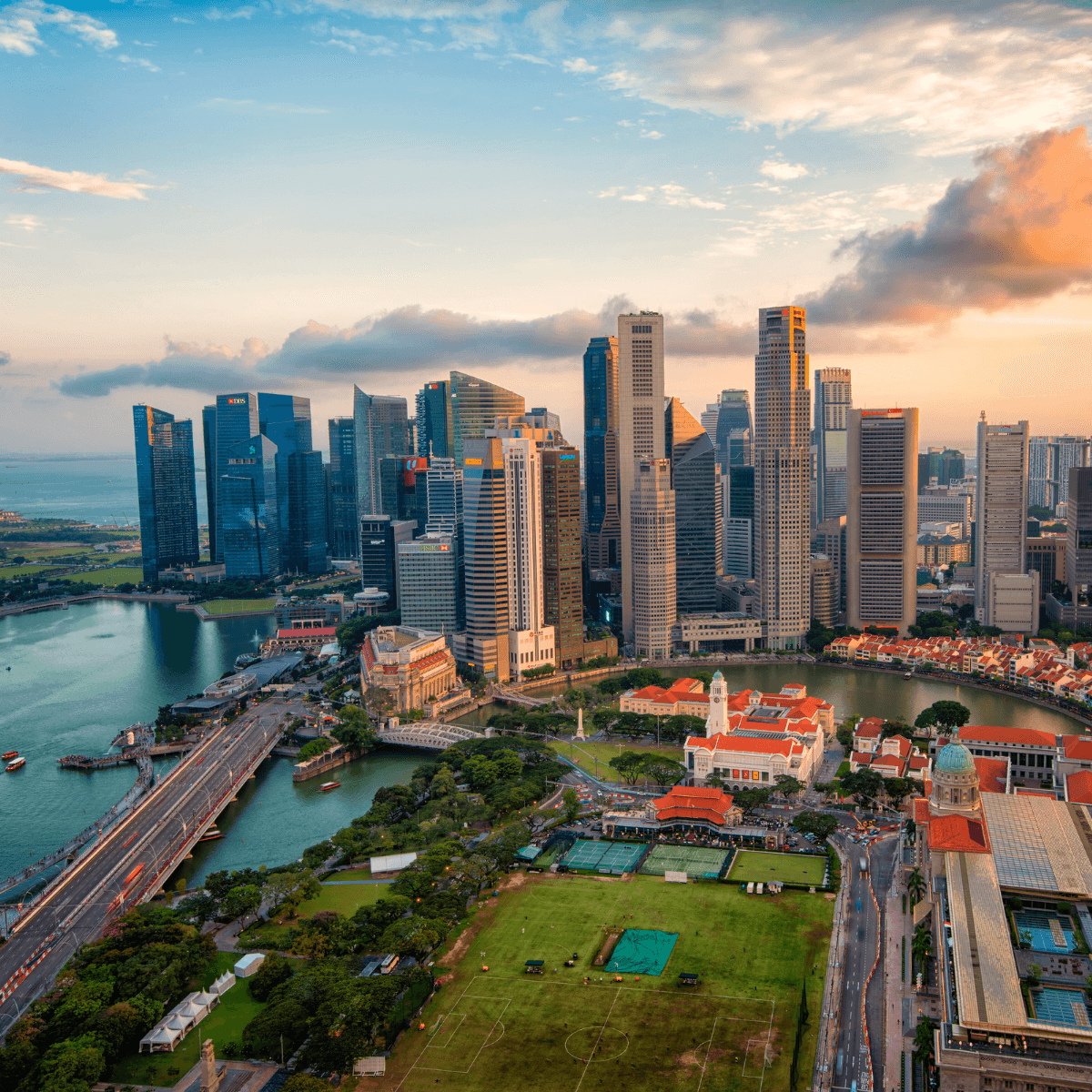

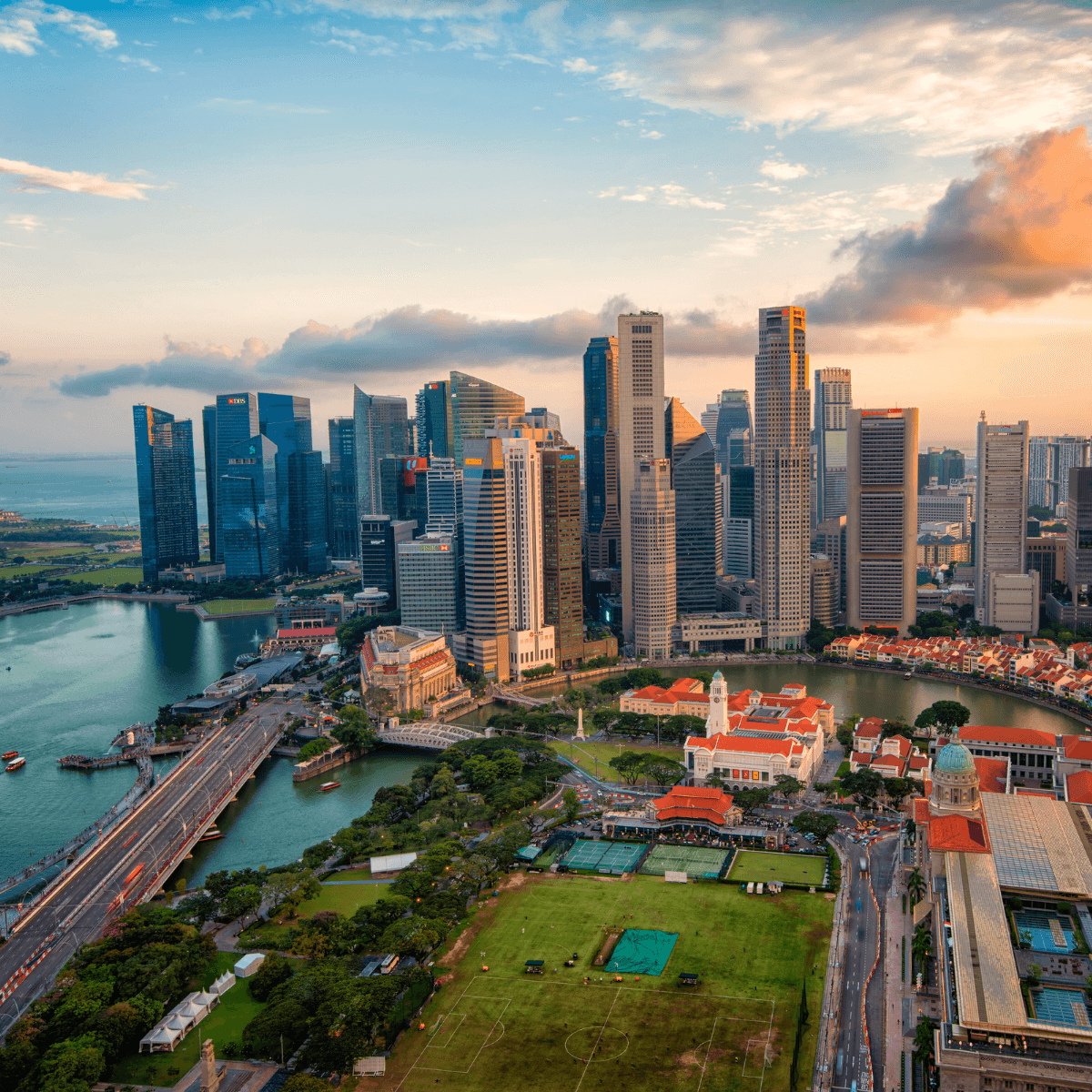

Why is Southeast Asia becoming the center of gravity for trade, the digital economy and culture? For two decades, Southeast Asia has been hedged. Capital flowed cautiously into the region while diplomats spoke in neutral tones, and governments practiced what some called bamboo diplomacy—staying useful to all sides without committing fully to any. China expanded its influence. America oscillated between engagement and retreat. And through it all, the region waited, building quietly and absorbing shocks—learning.

That posture is dissolving now. We are witnessing something different across the region: governments building with a confidence that would have been unthinkable a decade ago—muscular ministries, assertive industrial policy and investment terms that set conditions rather than offer concessions. The middle ground, once treated as a holding pattern, has revealed itself to be leverage. Not choosing sides isn’t ideology, it’s survival at its most strategic, and the benefits are finally surfacing.

The “Asian Century” is being reengineered, and its center of gravity is shifting south. Growth continues, but the terms have hardened. Supply chains are being recalibrated. Access now comes with conditions that don’t quietly expire.

Compute Is the New Currency

The same instinct toward self-determination carries into digital and artificial intelligence (AI) infrastructure. The old language of leapfrogging is no longer enough. What matters now is where data sits, who controls compute and what happens when access narrows without warning.

Governments across the region are setting requirements, not requests. Data centers, subsea cables, cloud jurisdiction, AI stacks: systems are being designed with the knowledge that access can be revoked, and dependencies exposed. The region builds alternatives and prioritizes self-reliance, even when partnership remains the preferred path. Cybersecurity and AI sovereignty mandates are creating a new chess game, one where data center builds have become geopolitical moves.

Southeast Asia’s Resource and Maritime Indispensability

Energy in Southeast Asia has never been merely a commodity play. It is strategic and structural. The region controls corridors that matter to half the planet. Indonesia is hardening supply chains through mineral dominance in nickel, bauxite and copper, all critical for EV batteries and renewable grids. Malaysia is enforcing new standards for petrochemicals and specialty chemicals, embedding national specifications into safety, certification and downstream compliance regimes that increasingly determine how regional producers access global markets..Singapore operates as a vault where energy finance, maritime control and futures clearing converge. The evolution from extraction to cultivation has accelerated. Whoever owns the chokepoints owns leverage, and Southeast Asia is no longer content to rent influence.

A New Era of Politics

Across the region, a new political settlement is taking shape, one that prioritizes performance over ideology and continuity over disruption. Vietnam’s leadership transition is being matched by assertive bureaucratic reform, with foreign investment no longer treated as opportunistic capital but as a core instrument of national development, exemplified by targeted initiatives such as Da Nang’s new free trade zone. Following the 14th National Congress, this is expected to translate into faster execution, clearer administrative lines and political backing for an increasingly entrepreneurial economy.

Thailand, fatigued by years of political paralysis and navigating a fragile transition ahead of the February 8 polls, is signaling a decisive turn toward stability and growth. The kingdom is placing a premium on policy continuity and investor confidence to anchor its economy and reclaim its standing on the global stage.

Myanmar remains a critical variable. Prolonged conflict and economic exclusion have hollowed out state capacity, narrowing the space for civil society, humanitarian action and basic livelihoods without delivering the political outcomes many external actors anticipated. Its long-term importance is structural: geography, resources and population make it consequential to regional stability regardless of near-term trajectories. Any eventual reintegration, when conditions allow, would be incremental and conditional, shaped as much by humanitarian considerations and institutional stabilization as by governance conditions on the ground. The question is no longer whether Myanmar will re-enter regional systems, but under what safeguards, and with what consequences for those most affected by continued exclusion.

When Culture Moves Like Capital

This is where Southeast Asia becomes most strategic. Soft power here is as calculated as statecraft; and music, fashion, food and religion have become diplomatic and economic levers that are now distinct, desirable and viral.

Vietnam, Thailand and Malaysia are converting culture into leverage, each in a different way, each aimed at a different future.

Vietnam’s turn has been the quietest and perhaps the most unexpected. For decades, Vietnamese hands stitched the world’s clothes with skill, but authorship always sat elsewhere. Vietnamese fashion was nonexistent, far removed from the runways of Paris and New York. When designer Phan Huy stepped onto the Paris Haute Couture calendar, young and unmistakably Vietnamese, it signaled something larger: the diaspora is now driving a new cultural agenda on the global stage. Soft power here comes from recomposing global codes with Vietnamese confidence and creativity.

Thailand is now a global hub for entertainment. Louder, more scaled, built on sophisticated policy statecraft. Where Vietnam refines taste, Thailand creates new nodes of global ecosystems through festival diplomacy.

Thailand is now a global hub for entertainment—louder, more scaled and built on sophisticated policy statecraft. Where Vietnam refines taste, Thailand creates nodes of global cultural circulation through festival diplomacy. Tomorrowland, EDC and Wonderfruit are not parties; they are systems of logistics, hospitality, media rights, visas, public security and sponsorship operating simultaneously as economic and cultural diplomacy. This logic extends beyond events, visible in national initiatives such as the Tourism Authority of Thailand’s “Amazing 5 Economy” campaign, which treats culture, nightlife, platforms and circularity as engines of economic growth. . Marriage equality in Thailand didn’t pass only as progressive politics, it arrived as a demonstration that inclusion and investment can move in lockstep. Thailand understood something important: inclusion functions as global economic strategy.

Malaysia, meanwhile, is building for a different century altogether. It is positioning itself as the cultural, culinary, financial and tourism anchor of a modern Muslim world that is young, mobileand economically ambitious in ways that defy old stereotypes. Halal is the clearest expression of this. While others treated halal certification as a food-bound compliance regime, Malaysia treated halal as an economy, a supply chain and a form of global civic infrastructure: standardized, scaled and exported across food, finance, travel, medtech and logistics. Halal in Malaysia is an inclusive, plural, globally usable system, one that invites participation across cultures and industries rather than being defined by insularity or restriction. The addressable market is enormous: nearly two billion people are looking for places and products that understand their needs.

Vietnam is a global tastemaker. Thailand is a global hub of entertainment. Malaysia is building the civilizational platform for the next Muslim century.

The energy across the region is unmistakable—so is the intent. Southeast Asia is not waiting for permission or validation. It is building systems, setting terms and inviting the world to participate on new conditions.

For those of us who have watched this region for decades, what we are witnessing is not emergence. The Asian Century is here, and its center of gravity has moved to Southeast Asia.

Related Articles

Looking Ahead: A 2026 Communications and Leadership Outlook

January 27, 2026

Seeing the Seeds of 2036: Five Foresight Signals Growing in 2026

January 23, 2026